You may not realize it, but you have an estate and “Estate Planning” isn’t just for the rich.

In fact, for families with relatively modest assets, good estate planning is crucial because they can afford to lose less of their wealth.

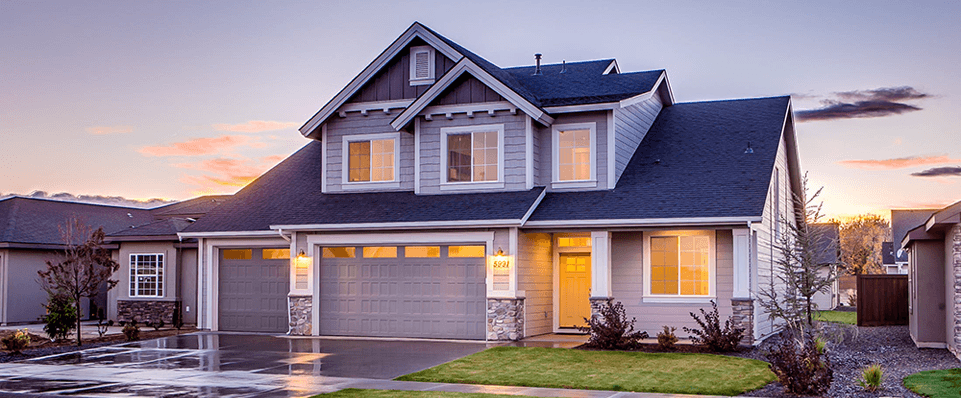

Your estate consists of everything you own - your car, your home, bank or investment accounts, life insurance or just some personal belongings. Estate planning allows you to determine who gets what and when, with as little as possible going towards taxes, legal fees, and court costs, but that’s not all it does…

In addition to a will, an estate planning attorney will work with you to create a health care proxy and durable power of attorney that communicates your wishes clearly, and they’ll guide you through the implications of each complex decision.

Federal and, in some cases, state taxes on estates, inheritances, and gifts can be among the highest. Minimizing the tax burden increases what you leave behind for your heirs.

Estate and gift taxes usually have exemption limits, this meaning you can only give up to a certain amount without being taxed. For this reason, many people use the gift tax exemption to start transferring assets while they are still alive.

Estate planning helps you organize your financial records, titles, and insurance policies so your heirs can find them if you become disabled or at the time of your death and it helps unearth any errors on titles or beneficiary designations that could lead to devastating tax consequences.

Death and disability don’t always give us fair warning so the time to get your affairs in order is now.

Call Parker & Associates at 941-952-0600, we’ll help you put together an estate plan that ensures your family can take advantage of everything you’ve worked so hard to provide for them once you’re gone.